Large cap vs Mid cap vs Small cap vs Flexi cap Mutual Fund

What are active mutual funds: Mutual Fund types and benefits

Active Mutual Funds are managed by professional managers. These Fund Managers are well-qualified and experienced in the field of investing. Investor’s money is wisely invested by Fund Managers in the stock market which naturally gives good returns.

Active Mutual Funds charges a small amount from an Investor called Expense Ratio for the various services given by them. In the long run, this benefits investor because it helps to bring more returns on their investment. Also, Mutual Fund House provides various services to investors.

|

Actively managed Mutual Funds are available in different categories. The most popular categories are Large Cap / MID Cap / Small Cap fund / Flexi Cap fund / Multi Cap / ELSS Fund / Sectorial Fund / / Thematic funds / Large and Mid Cap Fund.

1.. Large-Cap Mutual Funds: – Large-cap Mutual funds invest at least 80% of their AUM in large-cap stocks. Large Cap stocks are the first 100 NSE listed companies as per their market capitalization. The rest of the AUM can invest in MID and small CAP stocks. These funds are less volatile and give steady capital appreciation. Average returns from these large-cap mutual funds are 12 to 14%. They are suitable for safe and less risky investors. They provide the ability to your portfolio. Large Cap funds give steady returns with low risk.

2.. Mid-Cap Mutual Funds:- Mid Cap Mutual fund has to invest a minimum of 65% of its AUM in Mid Cap Stocks. Mid-caps stocks are those stocks having rank between 101 to 250 as per their market capitalization. Mid-cap funds have the potential to give more returns than large-cap funds. They are more volatile as compared to Large-cap funds but less volatile than small-cap funds. Mid-cap companies have the potential to become large-cap companies soon. They can give a return of 15 to 20 % in the short and long term.

3..Small Cap Mutual Funds: Small cap companies are 251 to 500 companies as per their market capitalization. Small-cap funds invest at least 65 % of AUM in small-cap stocks. Rest they can invest in Large and Mid-cap stocks. Small Cap Mutual funds are the most volatile and Risky as compared to Large and Mid-cap funds. But they give high returns as compared to any other mutual fund category. They are for investors having a high-risk appetite. Small-cap Fund investment is a high-risk & high return investment. Investors should have at least a time horizon of 5 Years and above if they are investing in small caps mutual funds. Top-performing small-cap mutual funds can give a return of more than 20%.

4…Flexi Cap Mutual Funds:- Flexi cap funds have no restriction on investing in any categories of stocks. However, they have to invest 65% of their AUM in equity stocks of any category. Rest AUM can invest in bonds, Gold, or other securities.

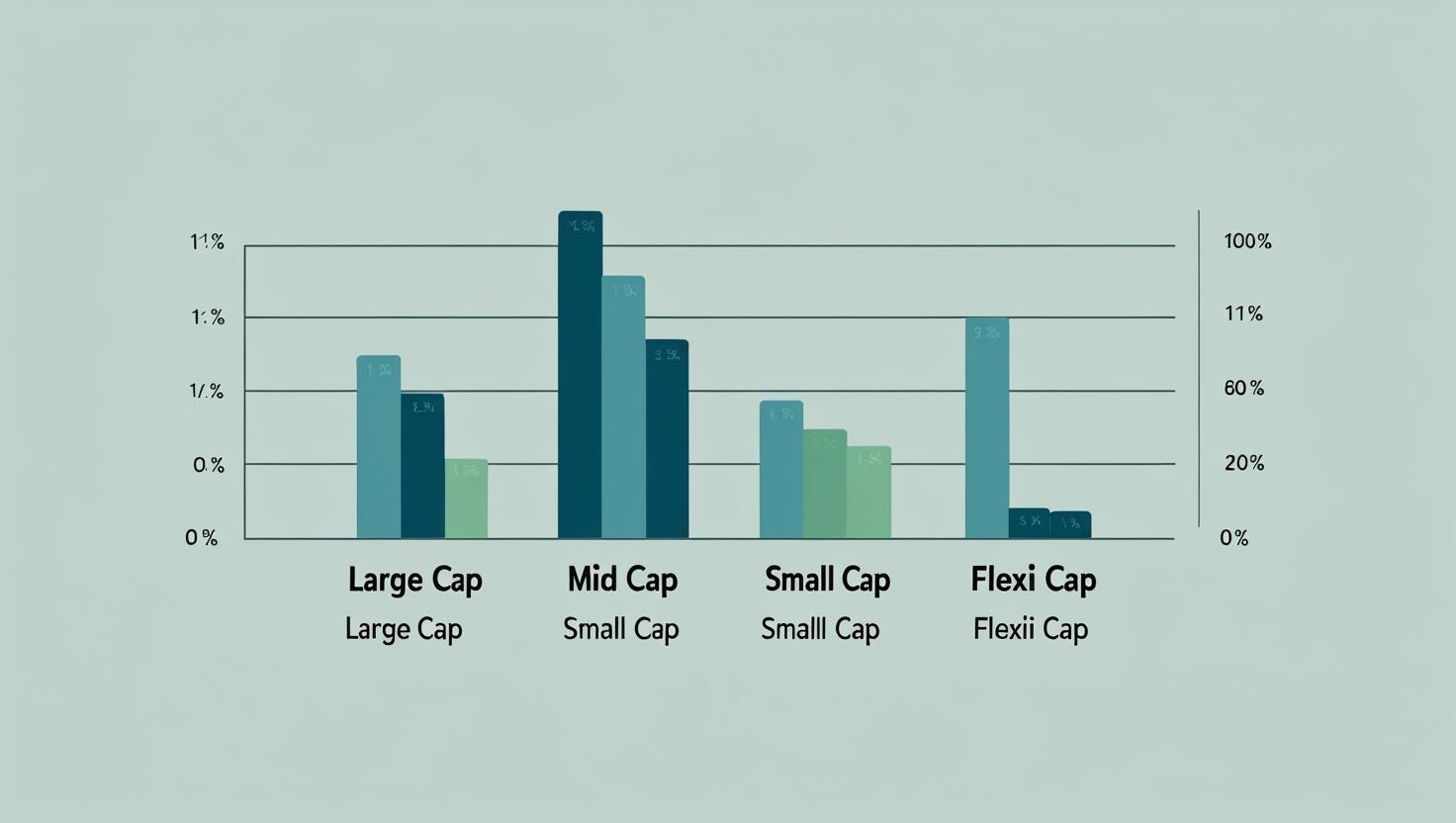

Comparative Study of Mutual Fund types Large cap vs Mid cap vs Small cap vs Flexi cap

|

LargeCap MF |

MidCap MF |

Small Cap MF |

Flexi Cap MF |

| Minimum 80% invest in Large cap Stocks. | Minimum 65% investment in Midcap Stocks. | Minimum 65% investment in Small cap Stocks. | No restrictions on investment in any category. But 65% should be in stock equity. |

| Less volatile. Steady Return. for Safe Investors. Steady Capital Appreciation. | More volatile than Large cap and less volatile than Small cap. Suitable for Medium Risktaking investors. More risky than large-cap MF and less risky as compared to small-cap MF. | Most Volatile & Risky, Suitable for High-Risk Appetite Investor. Performing small-cap MF can give a return of more than 20% in the long run. The investment horizon should be long-term (More than 5 Years | The Fund Manager plays a vital role in the performance of the Flexi Cap Fund. Medium Volatile. Medium Risk involved. Performing MF can give a good return of 15 to 20 %. |

5.. Multicap Mutual Funds:- Multicap funds have a restriction of investing at least 25% of their AUM in each large-cap, mid-cap, and small-cap stock. The rest of AUM can invest in any other equity or securities.

6.. ELSS Mutual Funds:- Equity Link Saving Scheme.

This is open open-ended equity fund scheme having a locking period of 3 years and has tax benefits. You will get a tax benefit under section 80 C of the Income Tax Act 1961. ELSS funds have to invest 80% of its AUM in Equity or equity-related instrument.

7.. Sectorial Fund:- Sectorial Mutual Fund Schemes invest in sector-specific stocks like banking, pharma, IT, etc. They are high-risk and high-profit mutual funds. If a particular sector performs well, it will deliver good returns. But if the investing sector goes down that will adversely affect its performance.

8.. Thematic Funds:- Thematic Funds invest in stocks of companies focusing on a particular theme

Like Real Estate, Transportation, Infrastructure, Health Care, Banking and Financial Services. They are also high-risk and high-profit mutual funds

9.. Large and Mid Cap Funds:- These mutual funds invest a minimum of 35% in large-cap and 35% in mid-cap stocks. Because they have to have a combination of Large and Mid-cap stocks They will give returns more than large-cap funds and less than mid-cap and small-cap funds.

The reader will also like to read about the following topics.

3. PE Ratio

5. Bull vs Bear Phase in Stock Market